how to avoid estate tax in california

For 2021 the annual gift-tax exclusion is 15000 per donor per recipient. While a California estate will have to be valued at least 10 million this exemption is not very high and can be a good way to avoid taxes on the decedents assets.

Understanding California S Property Taxes

While the rate range will remain the same going into 2022 the threshold at which the state charges estate tax has changed.

. Built By Attorneys Customized By You. MarriedRDP couples can exclude up to 500000 if all of the following apply. Just keep in mind that the 114 million threshold applies to both the gift tax and estate tax at the same time.

If you itemize deductions you can take a tax deduction for any charitable donations made while youre living. The California legislature has yet to pass the rules to interpret the exact implantation of Prop. California is quite fair when it comes.

California does not levy a gift tax. Set up an irrevocable life insurance trust. If you plan to gift your real estate to your children or grandchildren start planning now to avoid leaving them with a large property tax burden.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. For 2021 estates worth over 592 million were subject to taxation. To make sure you dont run into any trouble with the IRS here are ten tips to help you avoid capital gains tax when selling your property in California.

Transfer between husbands and wives are exempt from reassessment. Proper planning is required to avoid the problem of the County treating a transfer after death as being between siblings and not from parent to child. A living trust is a legal document that allows you to transfer ownership of your assets to another person.

Each California resident may gift a certain amount of property in a given tax year tax-free. There are a few ways individuals can protect their beneficiaries from inheritance tax. Browse discover thousands of brands.

Either spouseRDP meets the 2-out-of-5-year ownership requirement. You filed a joint return for the year of sale or exchange. The exception is if a spouse is a non-citizen.

This base rate is the highest of any state. Chat With A Trust Will Specialist. There are several ways to accomplish this.

Even if youre not in California there are still capital gains taxes depending on how your property was classified. How to Avoid Capital Gains Tax on Real Estate. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more.

Ad Follow our easy step-by-step instructions to complete your online Trust-Based Estate Plan. First a look at the previous and current New York estate tax rates. Charitable contributions can also reduce the value of your estate and help you reduce or avoid estate taxes.

With the passing of Californias Proposition 19 the ability to transfer your home or other real property to your children without property tax reassessment has been significantly reduced. In addition to property tax if you would like to learn more about other intergenerational transfer strategies to minimize your estate gift and generation-skipping transfer tax burden contact Jacqueline Yu at. In addition a parent can transfer up to 1000000 of assessed value not fair market value to the children or a child can do the same to the parents.

Prop 19 applies to all transfers of real property on or after February 16 2021. With careful planning gifting can be an excellent way to avoid probate and simplify your estate. One way to avoid probate in California is to use a living trust.

Give to charity while youre alive. We assist clients with proper planning to minimize or avoid future property tax reassessment. Consider the alternate valuation date.

Similarly the proposed 04 percent wealth tax would only be applicable for those with incomes above 30 million. Ad Fisher Investments has 40 years of helping thousands of investors and their families. Your gain from the sale was less than 500000.

California sales tax rates range from 735 to 1025. If youre trying to find ways on how to avoid paying California state income. 19 although it has already been implemented.

Both spousesRDPs meet the 2-out-of-5-year use requirement. In 2021 this amount was 15000 and in 2022 this amount is 16000. There are ten common methods to reduce estate taxes when you die and often reduce your tax returns today.

The income will go directly to beneficiaries and will not be passed on to the government. Neither lifetime gifts nor bequests in a will are subject to estate taxes if these assets are transferred to a surviving spouse. If you dont want to leave your family members in a difficult financial situation after you die its a good idea to buy life insurance.

No California estate tax means you get to keep more of your inheritance. Life insurance proceeds generally arent taxable. Estates valued at less than 1206 million in 2022 for single individuals are exempt from an estate tax.

New York uses a graduated estate tax rate that ranges from 306 to 16. Interspousal Transfers RT Code 63. Do this while you are still alive every year for as long as it takes to bring your overall estate below the 117 million mark.

Read customer reviews find best sellers. In some cases an executor might just have a different alternate valuation date which is 6 months following. Assessed value is the value described on the property tax bill not.

The exemption for 1000000 of other property is no longer effective. The anticipated hike would raise the rates to 143 on incomes over 1 million 163 on incomes over 2 million and 168 on incomes over 5 million. Minimize retirement account distributions.

However the federal gift tax does still apply to residents of California. The surest way to avoid or reduce estate taxes in California and other states is to give off portions of your estate as gifts to your beneficiary.

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

Understanding California S Property Taxes

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Pin By Terry Wilson On Wilson Inheritance In 2022 Revocable Living Trust Estate Planning Living Trust

California Estate Tax Everything You Need To Know Smartasset

Top 4 Gift And Estate Tax Avoidance Strategies Estate Tax Estate Planning Estate Planning Attorney

State Of California Real Estate Withholding Viva Escrow

Understanding California S Property Taxes

Taxes On Your Inheritance In California Albertson Davidson Llp

How To Probate An Estate In California By Julia Nissley Https Www Amazon Com Dp 1413318290 Ref Cm Sw R Pi Dp X Zt7 Zbx3c Probate Books To Read Online Estates

California Estate Tax Everything You Need To Know Smartasset

Understanding California S Property Taxes

Understanding California S Property Taxes

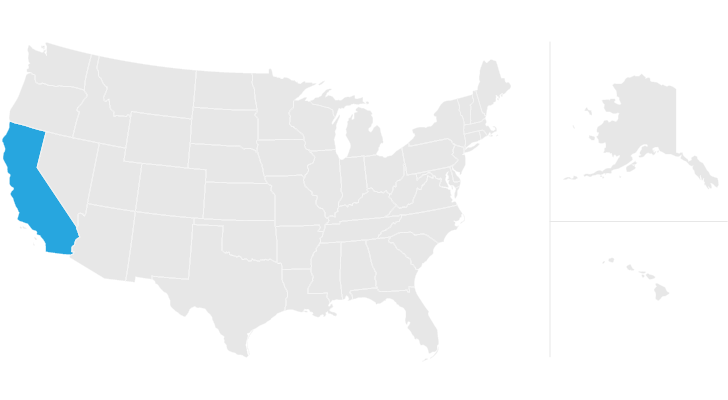

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Estate Taxes With A Trust

California Estate Tax Everything You Need To Know Smartasset

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

A California Living Trust Can Help You Avoid A Costly And Stressful Probate Process Https Apeopleschoice Com A Cali Living Trust California Revocable Trust